TSP's new Mutual Funds... Are they a good investment?

Bottom Line Up Front (BLUF): The TSP’s new mutual funds will add investing options, but with extra fees. Beware of these fees and other risks that come with these new mutual funds. For most people, investing in the traditional TSP funds (especially the C & S Funds) is usually a better strategy that comes with lower fees.

Image by Epic Top 10 Site

The Thrift Savings Plan (TSP) is adding an optional mutual fund window, where you’ll be able to invest in hundreds of mutual funds. However, make sure you understand the added risks that come with these new options.

First, I want to clarify that the current five (5) funds of TSP are not changing at all. You can still invest in the C, S, I, F, and G funds without paying any extra fees.

However, investing in the new mutual fund window will come with additional fees:

- $150 (or more) in annual maintenance fees

- $28.75 per trade (i.e. every time you make a change)

However, there is another type of fee to watch out for: the expense ratios of the mutual funds themselves.

As of this writing, these fees haven’t been announced. However, most actively-managed mutual funds have an average fee of 0.71%, though this varies widely between types of funds.

Still, even just a 1% fee, can severely reduce your return. I detail this in my previous post titled “Aggressively Cut Fees to Keep More of Your Profits”.

For more information on some of the added restrictions and potential issues with these new mutual funds, you can read more about it on FedSmith.com:

Why for almost everyone, buying the stock market (or S&P 500) is the best strategy

It is widely reported that around 92% of actively-managed mutual funds fail to match the performance of the market. So, based purely on math, nearly 9 in 10 people will lose money with actively-managed funds vs. just sticking to investing in main TSP funds that track the U.S. stock market (like the C and S funds).

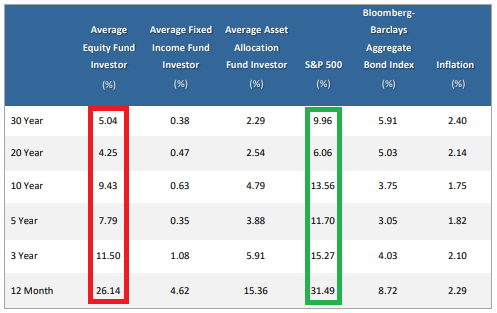

Another 2020 study showed that the average equity fund investor failed to keep up with the S&P 500 (i.e. the C fund). Over a 5 year span, the average invstor earned 7.8% vs. the S&P 500’s 11.7%. Though that doesn’t seem like a lot, this is a loss of 33% of their profits.

For more information about why buying the market is often the best strategy, read my previous post titled, “Follow the Market (with Index Funds) vs. Trying to Beat the Market.”

Why TSP mutual funds probably aren’t good for most investors

But, isn’t adding new features to TSP a good thing? Some people might benefit from it. And, for those who shouldn’t invest these new funds, having more options doesn’t hurt… does it?

Sometimes… due to the Paradox of Choice.

The paradox of choice is a phenomenon where having more choices actualy makes it harder to make decisions (of course) and leaves us less satisified with our decisions afterwards. Studies show that when more options are provided, fewer people participate in company retirement funds. I’m concerned that “analysis paralysis” may cause fewer military and government civilians to invest in the TSP, or just leave their money in the default fund.

In addition, I’m also concerned that others will blindly invest in mutual funds without considering the fees… and lose a lot of money in the process. Buying mutual funds with high fees (on top of extra fees to TSP) could cause many military members to lose money. Hopefully, my warning - and those on lots of other websites - can help people make more educated choices on these when they become available.

Finally, most people tend to follow the herd when investing. They read that a cryptocurrency or stock is up 150%, and they “invest” their rent money… and then the price drops like a stone. Warren Buffett warns that we should be “fearful when others are greedy, and greedy when others are fearful.” Trying to follow the latest investing trends usually leads to losses, and sometimes massive losses.

So, what is the verdict? For now, the TSP mutual funds are not available yet. More research will be needed once information on the actual mutual funds (and their fees) is available. However, I choose to remain very skeptical/borderline hostile unless the numbers convince me otherwise.

For yourself, please just be careful and consider fees when making choices about how to invest.