How Do Tax Brackets Work?... Simplified

Bottom Line Up Front (BLUF): In the U.S., you pay a higher percentage of taxes the more money you make (see chart below). However, you don’t pay your highest tax rate on all of your money. Instead, you pay the tax rate for each “bucket” of earnings. Also, it is based on your adjusted gross income, which is your total income minus all of your deductions.

Before I really became serious about my finances, I didn’t understand taxes. My first years in the military, I would take my W-2 from MyPay and a couple other documents to a volunteer on base, and then let them figure it out. I had no idea how much I paid in taxes, or how much I should get back. I just knew it was hard and I wasn’t doing it. But, even as I got older and started doing my own taxes, I still had a lot of things I didn’t understand.

For example, tax brackets. In the U.S., we have tax brackets where if you make more money, you pay a higher rate (percentage) of your income in taxes:

Tax Brackets for 2021 (Source: NerdWallet)

| Tax Rate | Single People (or Married Filing Separately) | Married Filing Jointly (most married people) | Heads of Household |

|---|---|---|---|

| 10% | Up to $9,950 | Up to $19,900 | Up to $14,200 |

| 12% | $9,950 to $40,525 | $19,9010 to $81,050 | $14,200 to $54,200 |

| 22% | $40,525 to $86,375 | $81,050 to $172,750 | $54,200 to $86,350 |

| 24% | $86,375 to $164,925 | $172,750 to $329,850 | $86,350 to $164,900 |

| 32% | $164,925 to $209,425 | $329,850 to $418,850 | $164,900 to $209,400 |

| 35% | $209,425 to $523,600 | $418,850 to $628,300 | $209,400 to $523,600 |

| 37% | Over $523,600 | Over $628,300 | Over $523,600 |

In short: The more you make, the larger percentage of your income you pay in taxes.

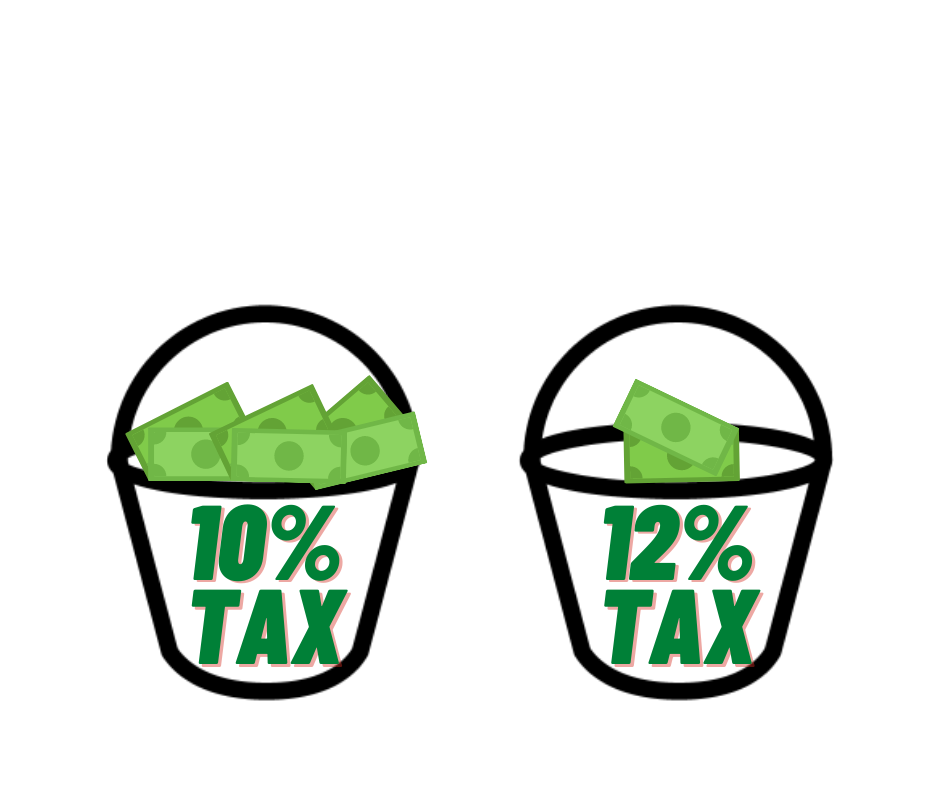

Simple, huh? Not quite. I’ve heard a lot of people misunderstand how this works. They think that they pay whatever their highest tax rate is on all of their earnings… but this is wrong. Instead, you pay the tax rate for each bucket of earnings. For example, if you are single making $10,000 a year, you’d pay 10% tax on the first $9,950… but you’d pay 12% tax on the rest of your income.

If this seems strange, think of tax brackets as literal buckets.

If you are single, your 10% bucket only holds $9,950. Once you fill that up, you start filling up your 12% bucket. Once you fill up your 12% bucket (by making more than $40,525), then you start filling up your 22% bucket.

This means that you don’t pay your highest tax rate on all of your earnings. Instead, you pay the tax rate for each bucket of earnings.

The other part of this you have to know is that your tax rates are based on your Adjusted Gross Income (AGI), not your total income. AGI is just your total income minus your tax deductions for the year. This means that the amount of money you are taxed on is probably less than you think.

Why does this matter at all?

Why does this matter? Well, I’ve heard people say that they would refuse a pay raise if it put them in a higher tax bracket. Or, they said that they didn’t want to go after a higher salary for the same reason.

These are really bad decisions. If a raise puts you just one dollar over your current tax bracket, only that extra dollar is taxed at the next higher tax rate! Moving into a higher tax bracket just mean that some of the extra you earn (not all of your earnings) could be taxed at a higher rate.

However, taxes do matter

Turning down a raise is a bad way to pay less taxes. However, maximizing your tax deductions is a smart way to lower your taxes. Finding legal ways to reduce your taxable income should be a priority for anyone, but especially for those in higher tax brackets.

As an investor, taxes are also a big deal. For example, selling short-term investments in a regular brokerage account can add to your taxable income (and be taxed at a high rate) vs. a lower capital gains rate for long-term investments. Also, investing in a Roth IRA or IRA (or in your TSP or Roth TSP) can save you from getting an unexpected tax bill.

UPDATE (21 Feb 2022): Read this new post for more information about how capital gains are taxed.